USDA

Mortgage Loan

Zero Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment Down Payment

- No Commitment

- No Strings Attached

- No Commitment

- No Strings Attached

Benefits

- Zero down payment required

- Lower interest rates compared to conventional loans

- Flexible credit requirements

- No maximum purchase price

Eligibility

- Property must be located within a USDA-designated rural area

- Minimum 640 FICO

- Household income must not exceed the area median income (AMI) where you are purchasing a home

- The property being purchased must be your primary residence

- Total housing payment may not exceed 33% of income

A USDA mortgage loan is a zero down payment mortgage option designed to make homeownership more accessible particularly in rural areas.

What is a USDA Mortgage Loan and How Does It Work?

A USDA mortgage loan is a zero down payment option that allows eligible borrowers to finance 100% of the home’s price (meaning, a 0% down payment is required). Therefore, if you’re purchasing a home for $300,000, your down payment can be as low as$0. You may still need to provide some or all of the purchase’s closing costs, although closing costs can be financed in specific cases, too. Compared to other loan programs, this option helps to make homeownership more accessible to individuals who may not have substantial savings but are otherwise financially responsible and capable of affording a mortgage.

Am I Eligible for a USDA Mortgage Loan?

To be eligible for the USDA mortgage loan, there are a few requirements to consider. First, this program is specifically designed for homebuyers who plan to occupy the home as their primary residence. Additionally, the property must be located in a USDA-designated rural area.

Your income must also meet certain guidelines based on the area median income (AMI) in your location. The specific income limits may vary depending on where you plan to purchase your home. You can check the most recent income limits here.

Finally, you do not need to be a first-time homebuyer to qualify for a USDA mortgage loan! But, if you currently own another property, additional requirements and parameters do apply.

Benefits of a USDA Mortgage Loan

- Zero Down Payment: USDA loans offer a zero down payment option, making homeownership more accessible to individuals with limited savings.

- Lower Interest Rates: USDA loans typically come with lower interest rates than conventional loans, which can result in significant savings over the life of the loan.

- Affordable Mortgage Insurance (called a “Guarantee Fee”): The USDA charges both up front and monthly guarantee fees, that are identical to FHA’s mortgage insurance, but at lower premiums.

USDA Loan Program Guidelines

The USDA loan program guidelines are designed to help borrowers living and working in rural areas achieve homeownership. The program allows:

- 100% financing, meaning no down payment is required.

- The ability to finance closing costs in some cases, further reducing out-of-pocket expenses.

- Lower mortgage insurance premiums compared to other loan programs.

- Flexible credit guidelines, making it more accessible to a wider range of borrowers.

- 1% up front guarantee fee (generally financed into the loan)

- 0.35% annual guarantee fee (paid monthly)

- Income caps based on the USDAs

USDA Home Loan Requirements

- Location: The property must be located in a USDA-designated rural area.

- Income Limits: Your household income must not exceed the area median income (AMI) for the location where you plan to purchase your home.

- Credit Score: 640 Minimum

- Occupancy: The home must be your primary residence.

Remember, these are the basic eligibility requirements. Contact Lendexa Mortgage to speak with a mortgage expert about additional requirements or variations on these basic eligibility criteria.

Credit Scores & Income Limits for USDA Loans

Understanding the role of credit scores and loan limits in the USDA loan process is crucial for prospective homebuyers. Here’s what you need to know:

USDA Credit Scores

Credit scores play a significant role in the USDA loan approval process. In order to qualify for a USDA loan, the lower-middle credit score across all borrowers must be at least 640.

This score is determined by a doing a credit check in which all 3 credit bureaus report a credit score back to the lender. The middle score is then the “qualifying” score used to determine eligibility.

If there are multiple borrowers on a loan, the middle scores are compared for each borrower, and the lowest one from all applicants must be used to determine program eligibility.

If your scores are below 640, there may be other loan programs, such as FHA Financing, that could be a suitable alternative. These options will require a larger 3.5% minimum down payment, however.

USDA Income Limits

Unlike other government backed mortgage programs, USDA loans set maximum income limits based on family size based on the area’s median income in which the subject property is located.

Households of 1-4 have lower income limits than households of 5-8. Beyond 8 people, the maximum allowable income grows by 8% for each 4-person increment.

At the lowest end of the spectrum, the maximum qualifying income is $110,650 for a 1-4 person household size, and $146,050 for a 5-8 person household size.

At the highest end of the spectrum, the maximum qualifying income is $238,200 for a 1-4 person household and $314,400 for a 5-8 person household.

In practice, most eligible USDA-designated rural areas fall in areas with lower income limits.

These income limits, combined with the strict debt-to-income housing ratio allowance of 29% mean USDA loans often do not give buyers as much purchasing power when compared with other loan solutions. This is because not only must borrowers earn a small enough income to qualify, they must earn a large enough income to keep their debt-to-income ratio within qualifying range.

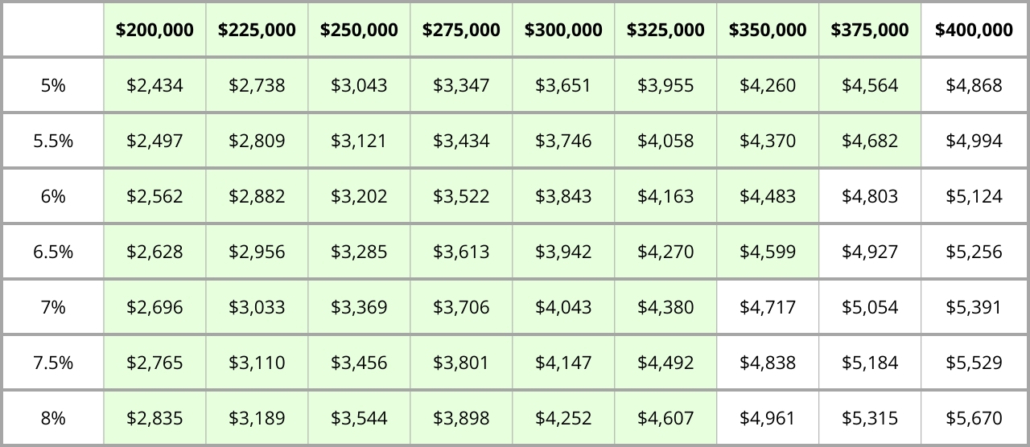

Here is an example of what a household of 4 earning $110,000/yr could qualify for with a USDA loan compared to an FHA loan.

This assumes a property tax rate of 1.5% and homeowner’s insurance of .5% – this example is purely for demonstrative purposes only.

Eligible Payments and Price Points with a USDA Loan

Eligible Payments and Price Points with an FHA Loan

Closing Costs for USDA Loans

USDA Loan Closing Costs

For USDA loans, closing costs can vary based on the lender and the specifics of the home purchase. However, they typically range from 1% to 3% of the loan amount. Here’s what you need to know:

1 Lender Fees: These are fees charged by the lender to process and underwrite the loan. They can include loan origination fees, credit report fees, and more.

2.Third-Party Fees: These are fees for services provided by third parties, such as the cost for a home appraisal, title search, title insurance, and home inspection.

3.Prepaid Items: These are costs that the homeowner pays in advance, such as prepaid interest, homeowners insurance premiums and property taxes.

4.USDA Guarantee Fee: This is a fee charged by the USDA to guarantee the loan. It’s typically 1% of the loan amount and can be rolled into the loan, meaning you don’t have to pay it out of pocket at closing.

Can USDA Closing Costs Be Financed?

One of the benefits of USDA loans is the ability to finance closing costs. If the home appraises for more than the sales price, closing costs can be included in the loan up to the appraised value. Even if the home appraises at the sales price, the Upfront Guarantee Fee can still be financed by the loan. This can significantly reduce the amount of money needed at closing.

However, it’s important to remember that financing closing costs means you’ll be paying interest on them over the life of the loan, which can add to the total cost of your mortgage.

Seller Credits

In some cases, the seller may agree to pay a portion of the closing costs, also known as seller credits. This can be a helpful way to reduce the amount of money needed at closing. However, seller concessions are subject to negotiation and are not always available; additionally, federal lending law caps the maximum amount of credits allowed on each transaction.

With USDA financing, sellers can credit up to 6% of the purchase price towards closing costs.

Pros and Cons of USDA Loans

Like any financial product, USDA mortgage loans come with their own set of advantages and disadvantages. It’s important to weigh these pros and cons carefully to determine if this type of loan is the right fit for your financial situation and homeownership goals.

Pros and Cons of USDA Loans

Like any financial product, USDA mortgage loans come with their own set of advantages and disadvantages. It’s important to weigh these pros and cons carefully to determine if this type of loan is the right fit for your financial situation and homeownership goals.

Pros

Zero Down Payment

One of the most significant benefits of USDA loans is the zero down payment requirement. This feature makes homeownership more accessible, especially for first-time homebuyers or those with limited savings.

Lower Interest Rates

USDA loans typically offer lower interest rates compared to conventional loans, which can result in significant savings over the life of the loan.

Flexible Credit Requirements

USDA loans are more forgiving when it comes to credit scores, making them an excellent option for borrowers with less-than-perfect credit.

Cons

Geographic Restrictions

USDA loans are only available for properties located in USDA-designated rural areas. This can limit your home buying options if you prefer to live in a more urban or suburban setting.

Income Limits

To qualify for a USDA loan, your household income must not exceed certain limits, which are based on the median income in the area in which the desired property is located. This typically results in very reduced purchasing power.

Mortgage Insurance

While USDA loans do not require a down payment, they do require an upfront guarantee fee and an annual fee, similar to mortgage insurance. These fees are used to protect the lender in case of default.

Low Debt-to-Income Ratios

In addition to the income restrictions, your purchasing power is further reduced with USDA financing as it requires your housing expense (including taxes, insurance, and guarantee fees) to be below 29%. This may create a sizeable gap between your purchasing power and the home prices in your desired area.

Take the Next Step with Lendexa Mortgage

Unlock the door to homeownership with the USDA mortgage loan. By allowing you to finance 100% of the home’s price, this program empowers homebuyers to achieve their dreams of owning a home. Before diving into the homebuying process, it’s important to research and explore your options thoroughly.

USDA loans are an attractive choice, but it’s essential to consider your personal circumstances, financial goals, and eligibility requirements to make an informed decision. By partnering with a trusted mortgage lender like Lendexa mortgage, you can navigate the homebuying journey with confidence.

NEXT STEP

Get your instant rate quote.

- No commitment

- No impact on your credit score

- Fast and easy

- No documents required

NEXT STEP

Get your instant rate quote.

- No commitment

- No impact on your credit score

- Fast and easy

- No documents required